43 jp morgan oil price forecast 2022

Oil prices likely to hit $125 per barrel in 2022: JPMorgan ... Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ production, JP Morgan Global Equity Research said. "As the group's (OPEC+ ... Gas prices could double next year, JP Morgan oil analysis ... An analysis of the oil market by J.P. Morgan predicts gas prices doubling in 2022 and 2023. AAA, which checks and tracks gas prices across the United States daily, reported that the barrel cost ...

JP Morgan Predicts $100 Oil | OilPrice.com 2 days EIA Hikes Oil Price Forecast To $105 ... swing into a deficit sometime in 2022. ... $100 at this point are higher than three months ago," JP Morgan's head of oil and gas ...

Jp morgan oil price forecast 2022

US EIA forecasts $70/b oil price, JP Morgan sees it at $125 Brent crude oil futures prices will average 70 U.S. dollars per barrel in 2022," the agency stated in the outlook. But, in a bullish report from JP Morgan, analysts are predicting $125 oil this year and $150 oil in 2023. The forecast, according to the report, is driven by the belief that OPEC has a limited capacity to increase oil production. JPMorgan (JPM) Says $185 Oil in View If Russian Supply Hit ... Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, JPMorgan Chase & Co. wrote in a note Thursday. Oil prices have skyrocketed, with Brent crude ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC ...

Jp morgan oil price forecast 2022. 2022 Market Outlook | J.P. Morgan Global Research J.P. Morgan forecasts the Fed to finish tapering by mid-2022 and to start hiking 25bp quarterly in September 2022. J.P. Morgan Research expects Treasury yields to rise in 2022, with the intermediate sector (bonds with a maturity of 2-10 years) leading the way. Gold SWOT: JPMorgan recommends increasing exposure to gold ... Opportunities. JPMorgan recommends increasing exposure to gold. Last week saw the highest inflation in commodity prices in 60 years (up 12% last week). Inflation risks are also severe due to the immediate supply shock to Russian commodity exports, along with the unfolding impact to downstream supply chains. Oil will spike to $150 in 2023, JPMorgan predicts - CNN Importantly, JPMorgan is not calling for oil to trade at $125 a barrel for all of 2022. Instead, the bank is predicting crude will average $88 next year and "overshoot" to $125 at some point. Oil price spikes to $139 on talks about Russia oil ban ... Analysts at Bank of America said if most of Russia's oil exports were cut off, there could be a 5 million barrel per day (bpd) or larger shortfall, pushing prices as high as $200. JP Morgan ...

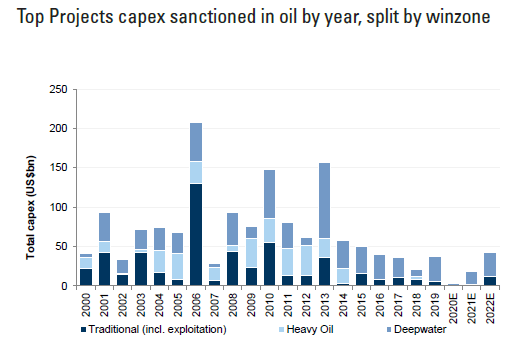

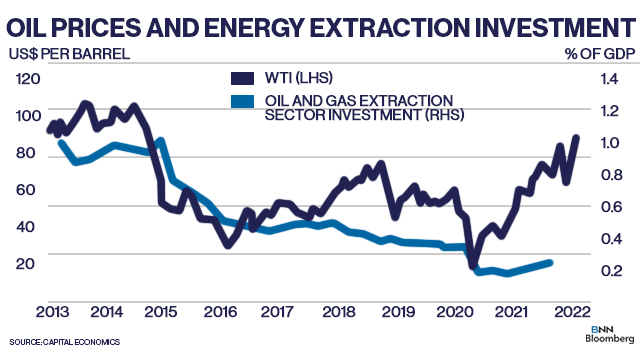

What's Next For Oil And Gas Prices As Sanctions On Russia ... Reflecting the higher risk premium across the oil market and wider commodities complex, the J.P. Morgan baseline view calls for the Brent oil price to average $110 /bbl in the second quarter of 2022, $100/bbl in 3Q22 and $90/bbl in 4Q22, with the possibility that prices rise as high as $120/bbl in the interim, depending on the state of geopolitics. Wall Street is beginning to cut S&P 500 forecasts as oil ... Wall Street is beginning to cut S&P 500 forecasts as oil prices surge Published: March 7, 2022 at 9:03 a.m. ET Jpmorgan Chase & Stock Forecast & Predictions: 1Y Price ... On average, analysts forecast that JPM's EPS will be $11.12 for 2022, with the lowest EPS forecast at $10.50, and the highest EPS forecast at $12.10. On average, analysts forecast that JPM's EPS will be $12.40 for 2023, with the lowest EPS forecast at $11.45, and the highest EPS forecast at $13.23. JP Morgan sees OPEC spare capacity falling through 2022 ... JP Morgan on Wednesday said it expects Organization of Petroleum Exporting Countries' spare capacity to fall through 2022, driving a higher risk premium to oil prices. JPM forecasts oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023. "We see growing market recognition of global underinvestment in

JP Morgan Forecasts $125 Oil Price in 2022, $150/bbl in ... JP Morgan Forecasts $125 Oil Price in 2022, $150/bbl in 2023. Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in the Organisation of ... Oil rally to power on as sanctions on Russia throttle ... Among the most bullish predictions, JP Morgan expects $185 oil by the end of 2022 if disruption to Russian exports lasts that long, although its average for the year was $98. Oil rally to power on as sanctions on Russia throttle ... Among the most bullish predictions, JP Morgan expects $185 oil by the end of 2022 if disruption to Russian exports lasts that long, although its average for the year was $98. The highest average predictions for 2022 were Rabobank and Raiffeisen with $111.43 and $110 respectively. Oil Prices Projected To Hit $125 In 2022 | OilPrice.com Oil Prices Projected To Hit $125 In 2022. By Irina Slav - Nov 30, 2021, 9:06 AM CST. In a new report from JP Morgan, analysts are predicting $125 oil next year and $150 oil in 2023. This bullish ...

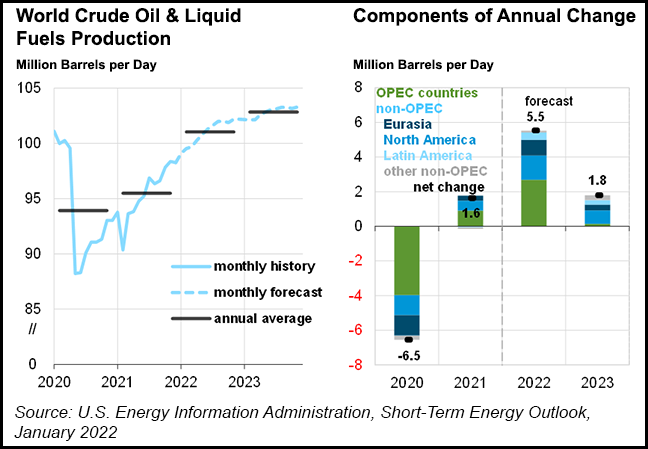

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. ... The bank forecast global oil demand to reach 99.8-101.5 million barrels per day in 2022-23.

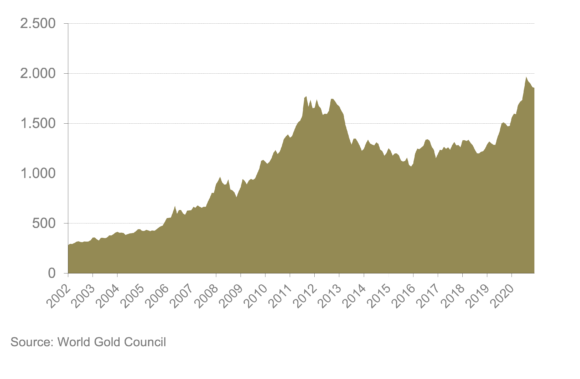

J.P.Morgan sees gold price unable to withstand the Fed ... At the same time, J.P.Morgan expects the U.S. dollar to rise 1.6% next year. Looking at economic growth forecasts, J.P.Morgan expects the global economy to 4.8% in 2022, with the U.S. economy expanding 3.8%. While the U.S. bank is bearish on gold through 2022, the bank is bullish on the rest of the commodity complex.

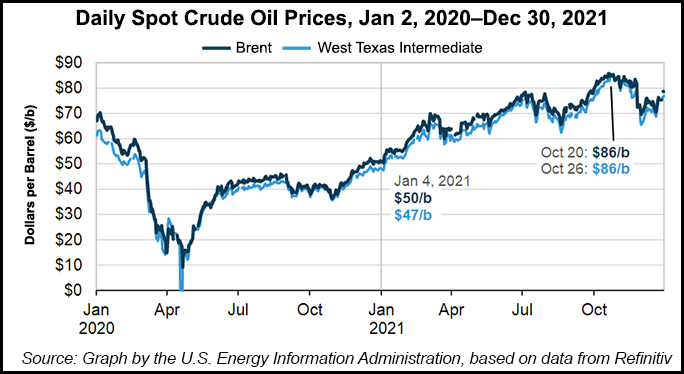

Why are oil prices soaring? | J.P. Morgan Asset Management Oil prices have risen substantially this year; WTI crude is up 60.1% to $77.43/bbl and Brent has risen 58.1% to $80.98/bbl 1.While it was expected that easing pandemic conditions would support demand for oil, the move in spot prices this year has caused investors to question whether these price pressures will persist and lead to higher inflation.

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. December 2, 2021, 7:09 AM. FILE PHOTO: An oil pump is seen near Bakersfield. (Reuters) - Oil prices are expected to overshoot $125 ...

Soaring prices set stage for eventual reversal of oil, gas ... Analysts at JP Morgan Chase & Co and Bank of America have predicted oil could hit $185 to $200 per barrel if Russia's oil exports are broadly shunned. U.S. lawmakers have called for bans on Russian oil but President Joe Biden's administration has sanctioned Russian oil tankers only, leading trading houses and refiners to avoid supplies ...

Factbox-JP Morgan says oil demand to surpass 2019 levels ... JP Morgan expects crude oil demand to surpass 2019 levels by March 2022, driven by a rebound in economic activities and countries reopening their borders, the bank said in a research note on ...

Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan. OPEC production shortfalls will spark the move, J.P. Morgan says. 'OPEC+ is not immune to the impacts of underinvestment.'. Brent crude ...

Outlook 2022: Preparing for a vibrant cycle | J.P. Morgan ... The foundation for a vibrant cycle. The global crisis has shifted policymaker priorities, solidified household and corporate balance sheets, and embedded innovation. This should set the table for more potent economic growth in the 2020s than we saw in the 2010s. USD4 trillion U.S. Government has spent in response to the pandemic 1.

Gold Price Forecast 2022: A Contrarian View To JPMorgan's ... JPM. $131.87. -1.18%. Gold. $1,981.92. -0.72%. According to a 2022 market outlook report published by J.P. Morgan Global Research recently, the gold price will be under pressure given the ...

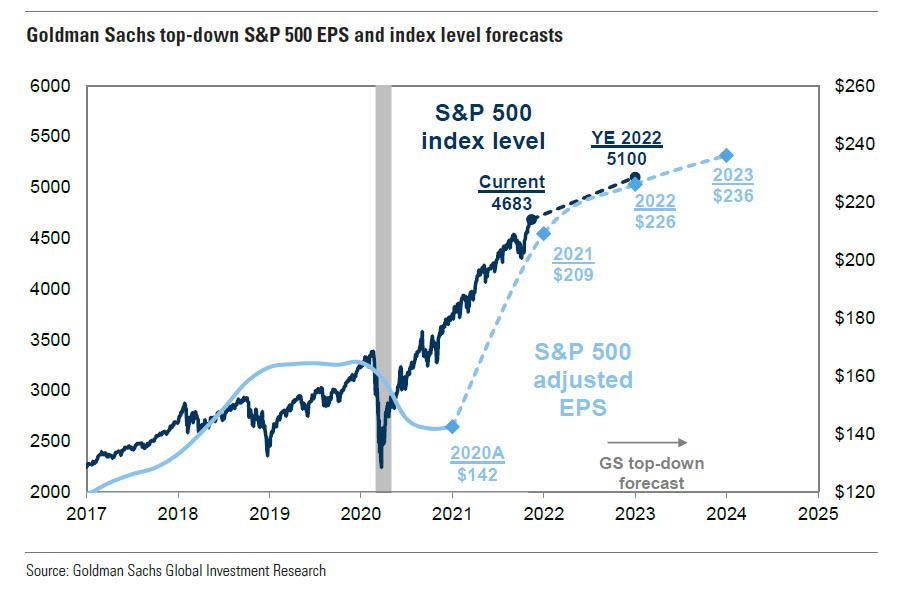

JPMorgan's S&P 500 forecast for 2022 is among the most ... JPMorgan's S&P 500 forecast for 2022 is among the most bullish on Wall Street. Here's the biggest risk it sees for stocks. Published: Nov. 30, 2021 at 7:05 a.m. ET

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC ...

JPMorgan (JPM) Says $185 Oil in View If Russian Supply Hit ... Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, JPMorgan Chase & Co. wrote in a note Thursday. Oil prices have skyrocketed, with Brent crude ...

US EIA forecasts $70/b oil price, JP Morgan sees it at $125 Brent crude oil futures prices will average 70 U.S. dollars per barrel in 2022," the agency stated in the outlook. But, in a bullish report from JP Morgan, analysts are predicting $125 oil this year and $150 oil in 2023. The forecast, according to the report, is driven by the belief that OPEC has a limited capacity to increase oil production.

0 Response to "43 jp morgan oil price forecast 2022"

Post a Comment