42 is service revenue an asset

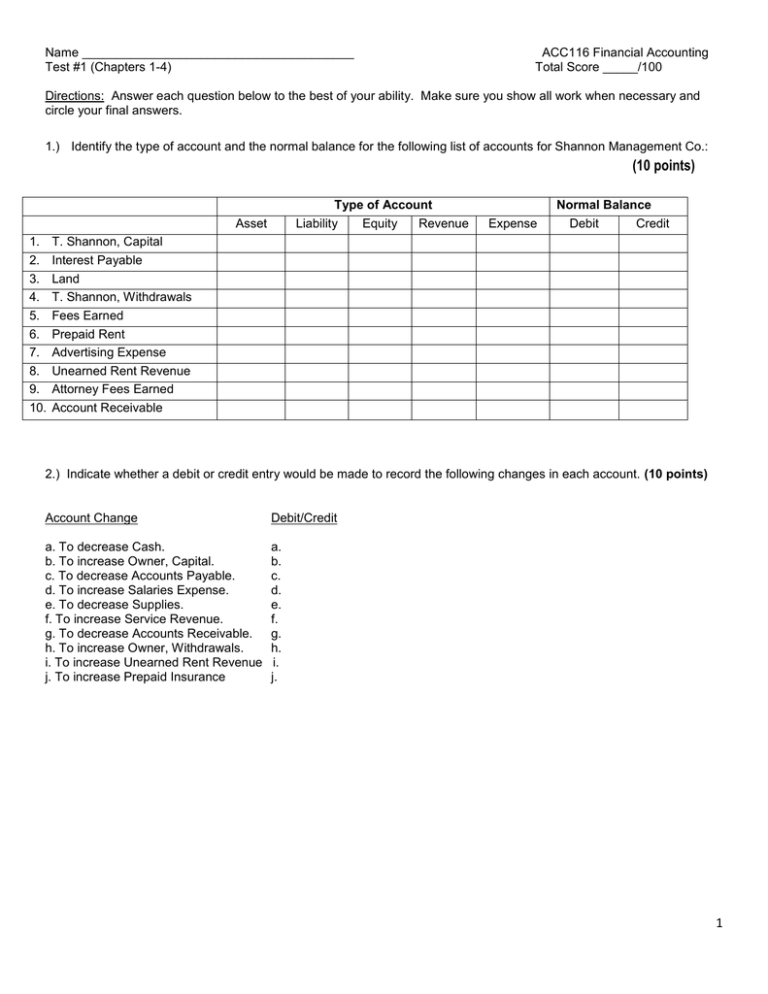

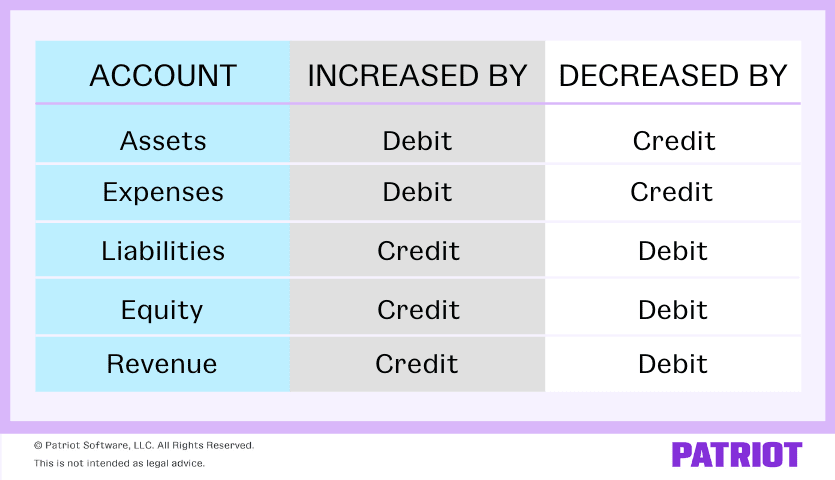

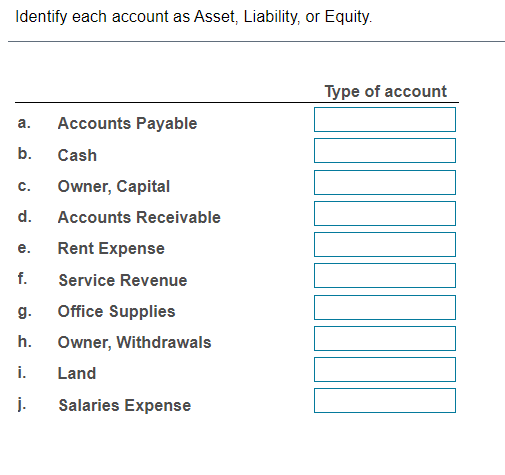

Is Service Revenue an Asset? Breaking down the Income Statement Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company’s total revenue during a specific time period. In a double entry system of accounting, service revenue bookkeeping entries reflect an increase in a company’s asset account. Is service revenue an asset or liability? - Answers Services revenue is revenue same as product revenue and it is not an asset or liability of the business. Home Study Guides Science Math and Arithmetic History Literature and Language Technology...

OneClass: is service revenue an asset 11 Dec 2019 is service revenue an asset Answer + 20 Watch For unlimited access to Homework Help, a Homework+ subscription is required. Irving Heathcote Lv2 11 Mar 2020 Unlock all answers Get 1 free homework help answer. Already have an account? Log in Like skylouse485 is waiting for your answer Log in to answer + 20

Is service revenue an asset

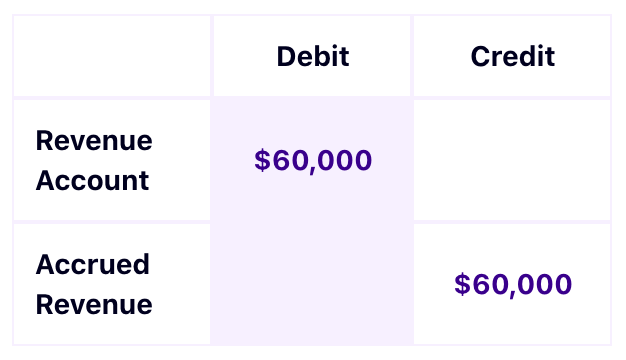

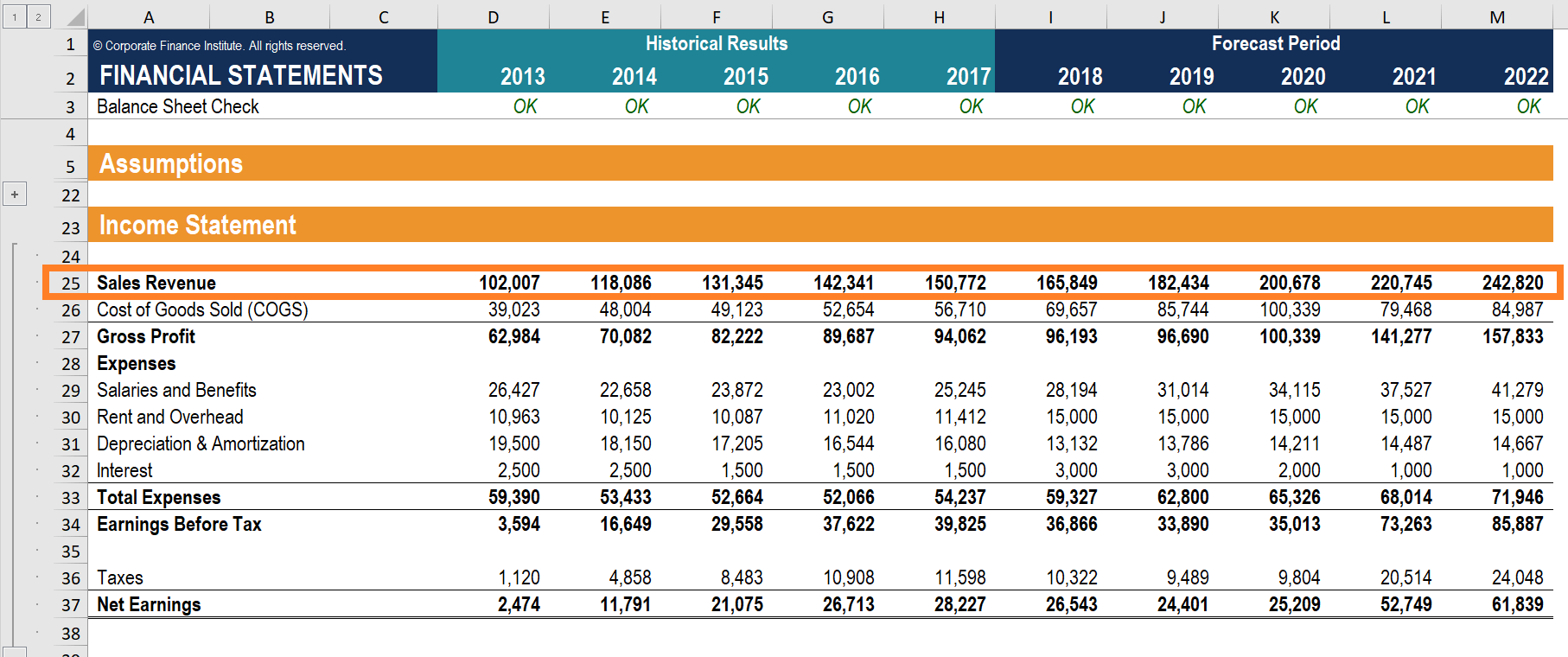

Virtual Asset Service Providers ('VASPs') | Central Bank ... Virtual Asset Service Providers ('VASPs') Regulation of providers of services relating to virtual assets. The European Union’s Fifth Anti-Money Laundering Directive ('5AMLD') extended Anti-Money Laundering and Countering the Financing of Terrorism ('AML/CFT') obligations to entities that provide certain services relating to virtual assets. Service revenue definition - AccountingTools Service revenue is the sales reported by a business that relate to services provided to its customers. This revenue has usually already been billed, but it may be recognized even if unbilled, as long as the revenue has been earned. Service revenue does not include any income from the shipment of goods, nor does it include any interest income. Is Service Revenue an Asset? - Deskera Blog Service revenue is a revenue account that records the income a business earns from providing goods and services to customers. It’s part of the income statement along with other types of revenue and business expenses. Service revenue is recognized under the accrual basis of accounting. In accrual accounting, cash gets recorded when the transaction occurs, not when money exchanges hands. That means completed services to which the charges haven’t been collected yet, are still considered as service revenue. So, for example, a bill for an unpaid service is part of the income statement as service revenue, even if the client hasn’t yet paid the invoice. But how exactly is this revenue recognition done? Let’s check out the journal entriesnecessary in order to record service revenue into the accounting books.

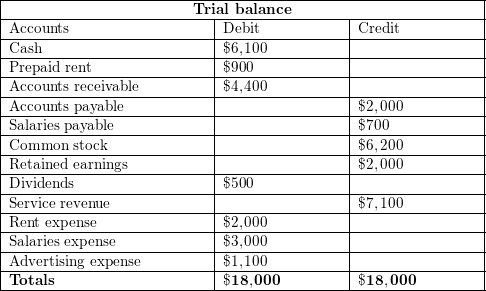

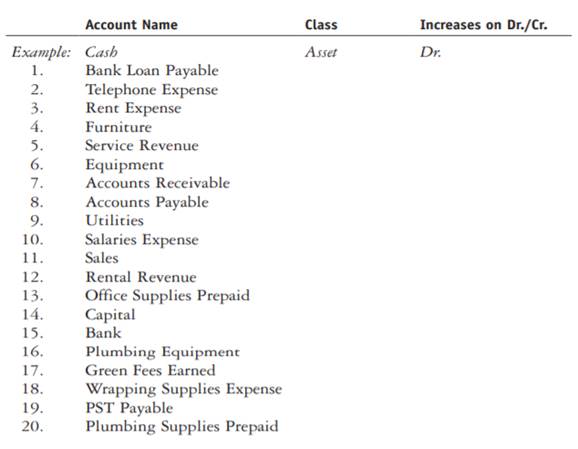

Is service revenue an asset. Accounting Unit 1 Flashcards - Quizlet Asset 4. Service Revenue Equity 5. Prepaid Insurance Asset 6. Accounts Payable Liability 7. Unearned Revenue Liability 8. Notes Receivable Asset 9. Brock, Withdrawals Equity 10. Insurance Expense Equity. Consider the following accounts and identify each as an asset (A), liability (L), or equity (E). 1. Rent Expense Is Service Revenue an Asset? Breaking down the Income ... The income a company earns from providing a service is referred to as service revenue. The amount is shown at the top of an income statement and is added to product earnings revenue to show a company's total revenue for a given time period. Is service revenue an asset? | Study.com Service revenue is not an asset, but a revenue or income account. The five types of account classifications are: assets, which are items that a... See full answer below. Become a member and unlock... Is service revenue an asset, liability, stockholders equity or net ... Answer: Net income. A service revenue is a component of the net income. Net income is the excess of all revenues earned over all costs incurred...

Is Service Revenue Asset or Liability + How to Calculate It Oct 28, 2021 · Service revenue may be an asset for your business, depending on its stage in life. New companies should use it to help them grow and establish themselves as leaders within their industry. On the other hand, mature businesses can put this money toward building reserves that'll protect company value if managers aren't able to secure capital from elsewhere. Is service revenue an asset? - Quora Service revenue is a income statement account and not balance sheet. If service revenue comes in the shape of cash, the cash assets of the company rise. CH.20.pdf - Items Balance, Jan. 1, 2022 Service cost ... View CH.20.pdf from ACCT ACCT3112 at The Chinese University of Hong Kong. Items Balance, Jan. 1, 2022 Service cost Interest expense(a) Interest revenue(b) Contributions Benefits Asset gain Is service revenue an asset account? - Answers Sales is not an asset, liability or equity account rather it is a revenue account and part of income statement rather balance sheet. Is a service revenue that is billed but not paid a credit or...

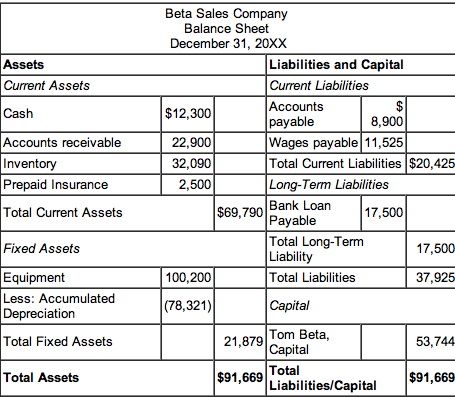

Is Service Revenue a Current Asset? | Finance Strategists No, service revenue is not a current asset for accounting purposes. A current asset is any asset that will provide an economic value for or within one year. Service revenue refers to revenue a company earns from performing a service. Revenue Definition 22/08/2021 · Quarterly Services Survey: A survey produced quarterly by the Census Bureau that provides estimates of total operating revenue and percentage of revenue by customer class for communication-, key ... Accounting Basics: Assets, Liabilities, Equity, Revenue ... Income or Revenue Income is money the business earns from selling a product or service, or from interest and dividends on marketable securities. Other names for income are revenue, gross income, turnover, and the "top line." Net income is revenue less expenses. Other names for net income are profit, net profit, and the "bottom line." Is accounts receivable an asset or revenue? - AccountingTools 25/06/2021 · Accounts receivable is the amount owed to a seller by a customer. As such, it is an asset, since it is convertible to cash on a future date. Accounts receivable is listed as a current asset on the balance sheet, since it is usually convertible into cash in less than one year.

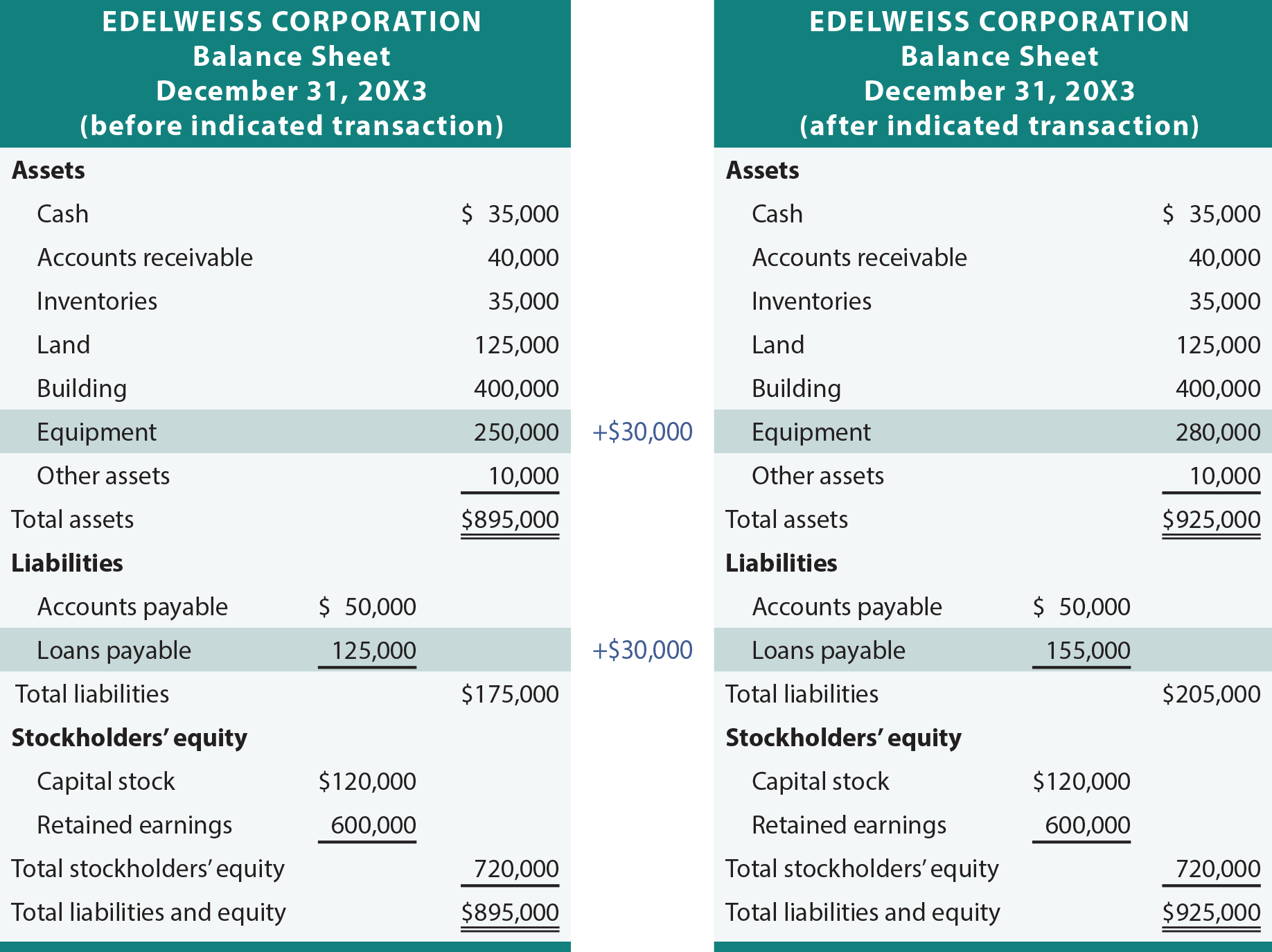

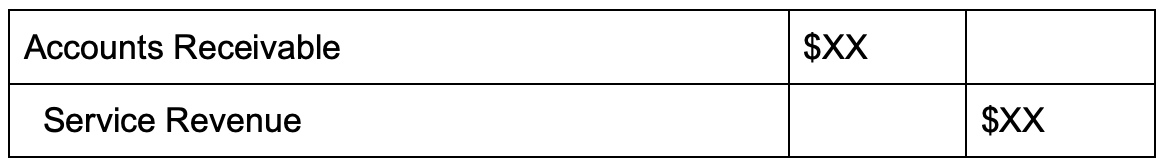

Chapter 2 DSM Flashcards | Quizlet Service Revenue (C) 2,200 Service Revenue earned on account would cause Account Receivable, an asset, to increase (debit) and Service Revenue, an equity account, to increase (credit).

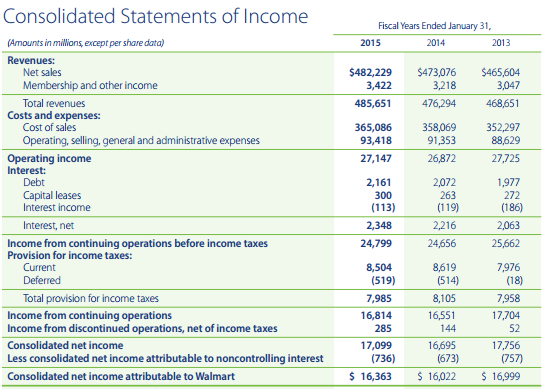

What Are the Differences Between Assets and Revenue? | The ... Revenue is tangentially related to an asset. If Wal-Mart sells a prescription to a customer for $50, it might not receive the payment from the insurance company until one month later. However, it...

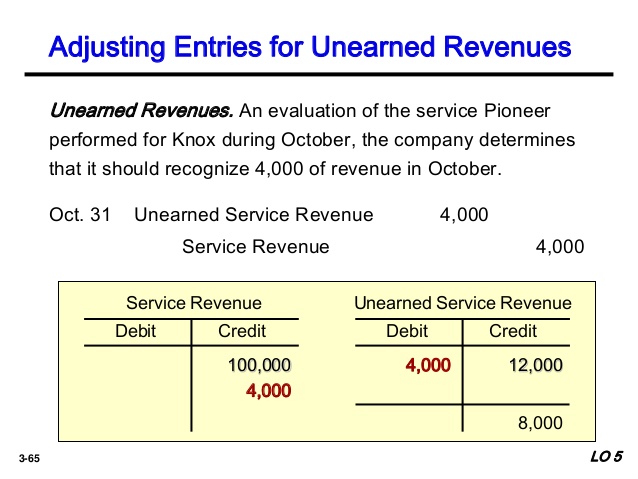

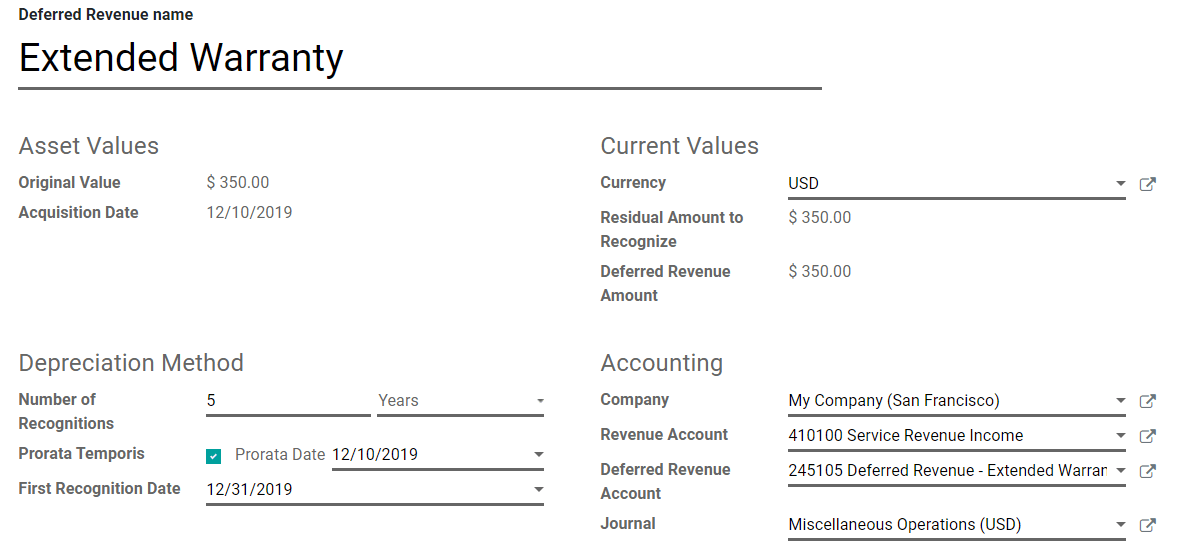

Is Unearned Revenue an Asset or Liability? - Wikiaccounting IS UNEARNED REVENUE AN ASSET OR LIABILITY? Unearned revenue Introduction: Unearned revenue is the cash proceeds received by a company or individual for a service or product that the company or individual still has to deliver to the customer.

1.35.6 Property and Equipment Accounting | Internal ... 23/04/2021 · Knowledge, Incident/Problem, Service and Asset Management (KISAM) ... gains, and losses are reported as a program cost or earned revenue on the Statement of Net Cost. 1.35.6.4 (04-23-2021) Property and Equipment Capitalization. This section provides guidance for the capitalization and depreciation of property and equipment. According to SFFAS No. 6, …

Is service fees a revenue? - FindAnyAnswer.com Service revenue is an operating revenue account and includes work that has been fully performed, irrespective of whether or not it has yet been billed for. Is a service revenue an asset? Service revenue is not an asset , but a revenue or income account.

Sale of a Business | Internal Revenue Service 28/05/2021 · For more information, see Internal Revenue Code section 332 and its regulations. Allocation of consideration paid for a business. The sale of a trade or business for a lump sum is considered a sale of each individual asset rather than of a single asset. Except for assets exchanged under any nontaxable exchange rules, both the buyer and seller ...

Is Service Revenue an Asset? - Skynova.com Dec 31, 2020 · Service revenue is a financial term that refers to the income a company makes by providing a service. If you're a service company of any kind, whether you do hairstyling or landscaping, it's important to know the basics about service revenue. Service revenue is not an asset itself. However, service revenue does contribute to your "asset account" in your ledger if you use the double-entry system of accounting.

Service Revenue - Definition and Explanation Service revenues can arise from rendering services for cash or on account (on credit) to be collected at a later date. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. Cash is an asset account hence it is increased by debiting it. Service Revenue is a revenue account; it is increased by crediting it.

Is Service Revenue an Asset? - FundsNet Dec 21, 2021 · So yeah, service revenue is not an asset. Rather, it is a revenue account. The confusion is understandable though as when you earn service revenue, your total assets also increase. For example, when you perform a service, you either earn cash or a promise to be paid at a later date (accounts receivable). What we can gather from this is that service revenue itself is not an asset, but it does contribute to the accumulation of assets. Recording service revenue in your books

Revenue & Reservations Manager - Phaedrus Asset Management … We are seeking to recruit a Revenue & Reservations Manager ☰ ΕΙΣΟΔΟΣ ; ΕΓΓΡΑΦΗ ΧΡΗΣΤΩΝ * * Loading… ΑΡΧΙΚΗ; ΤΕΛΕΥΤΑΙΕΣ ΑΝΑΡΤΗΣΕΙΣ; ΕΤΑΙΡΕΙΕΣ; ΑΓΟΡΑ ΥΠΗΡΕΣΙΑΣ. ΓΙΑ ΚΥΠΡΟ; ΓΙΑ ΕΛΛΑΔΑ; BLOG; ΕΠΙΚΟΙΝΩΝΙΑ; FREELANCERS. ΠΡΟΒΟΛΗ FREELANCERS; ΓΙΝΕ FREELANCER; ΕΙΣΟΔΟΣ ΕΓΓΡΑΦΗ �

Is Service Revenue an Asset? - Deskera Blog Service revenue is a revenue account that records the income a business earns from providing goods and services to customers. It’s part of the income statement along with other types of revenue and business expenses. Service revenue is recognized under the accrual basis of accounting. In accrual accounting, cash gets recorded when the transaction occurs, not when money exchanges hands. That means completed services to which the charges haven’t been collected yet, are still considered as service revenue. So, for example, a bill for an unpaid service is part of the income statement as service revenue, even if the client hasn’t yet paid the invoice. But how exactly is this revenue recognition done? Let’s check out the journal entriesnecessary in order to record service revenue into the accounting books.

Service revenue definition - AccountingTools Service revenue is the sales reported by a business that relate to services provided to its customers. This revenue has usually already been billed, but it may be recognized even if unbilled, as long as the revenue has been earned. Service revenue does not include any income from the shipment of goods, nor does it include any interest income.

Virtual Asset Service Providers ('VASPs') | Central Bank ... Virtual Asset Service Providers ('VASPs') Regulation of providers of services relating to virtual assets. The European Union’s Fifth Anti-Money Laundering Directive ('5AMLD') extended Anti-Money Laundering and Countering the Financing of Terrorism ('AML/CFT') obligations to entities that provide certain services relating to virtual assets.

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

![Solved] a) Record the income tax journal entry on December 31 ...](https://s3.amazonaws.com/si.experts.images/questions/2020/03/5e7b13cf060d7_1585124246785.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

0 Response to "42 is service revenue an asset"

Post a Comment