41 defined contribution pension plan definition

PDF Defined contribution retirement plans: Who has them and ... Defined contribution retirement plans are an important component of employer-sponsored benefit packages. These plans accumulate tax-deferred savings in individual employee accounts established by the employer. The government provides tax and savings incentives to both employers and employees by making it legal to set aside What is a defined contribution pension? | PensionBee A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions.

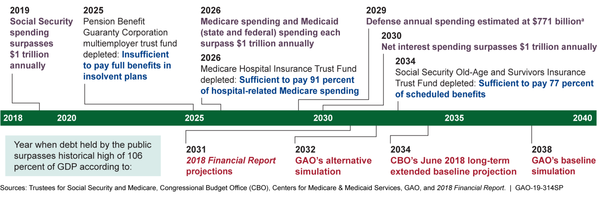

› 2022_401k_plan_limits2022 401k Retirement Plan Contribution Limits ... The limitation for defined contribution plans under section 415(c)(1)(A) is increased in 2022 from $58,000 to $61,000. The Code provides that various other dollar amounts are to be adjusted at the same time and in the same manner as the dollar limitation of section 415(b)(1)(A).

Defined contribution pension plan definition

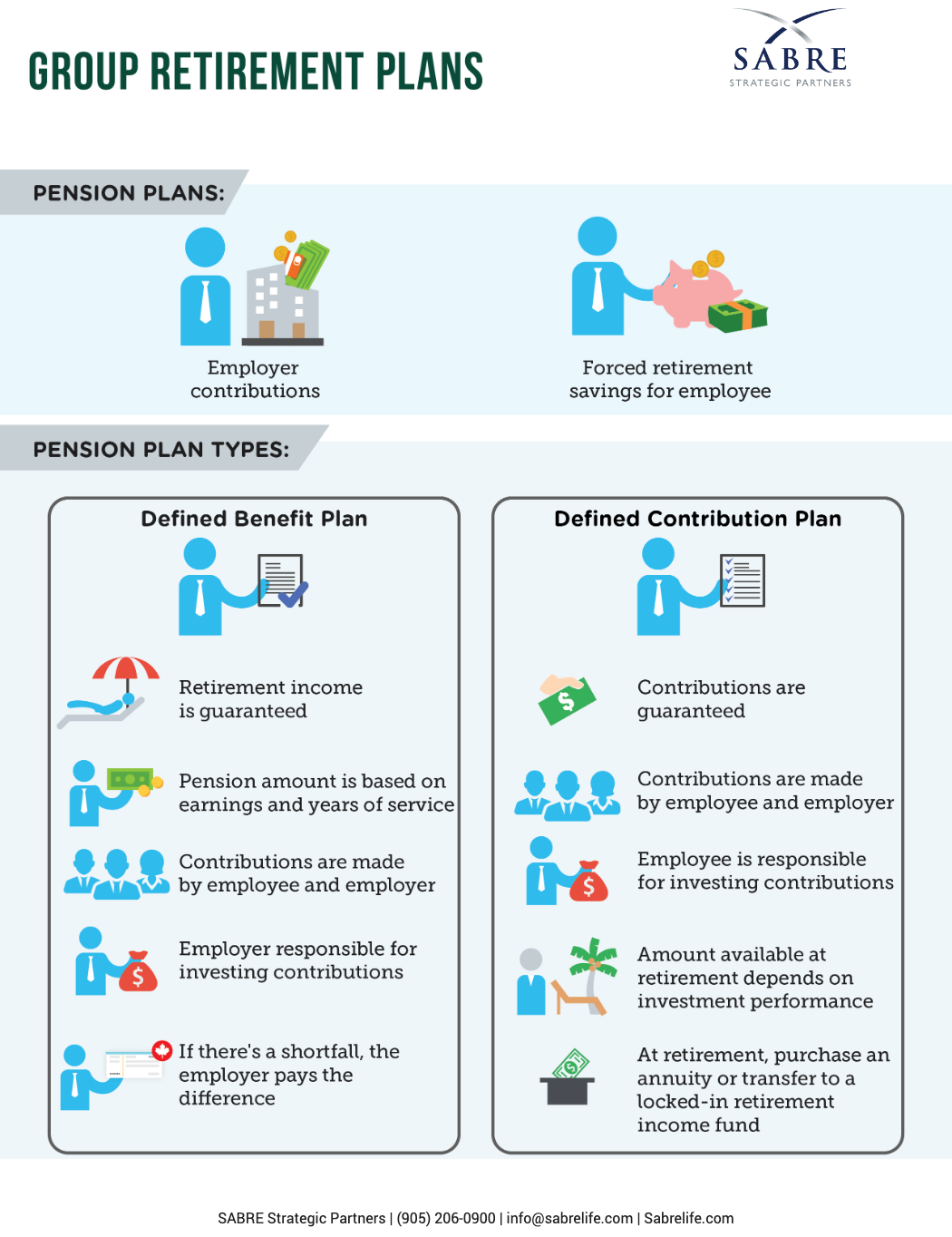

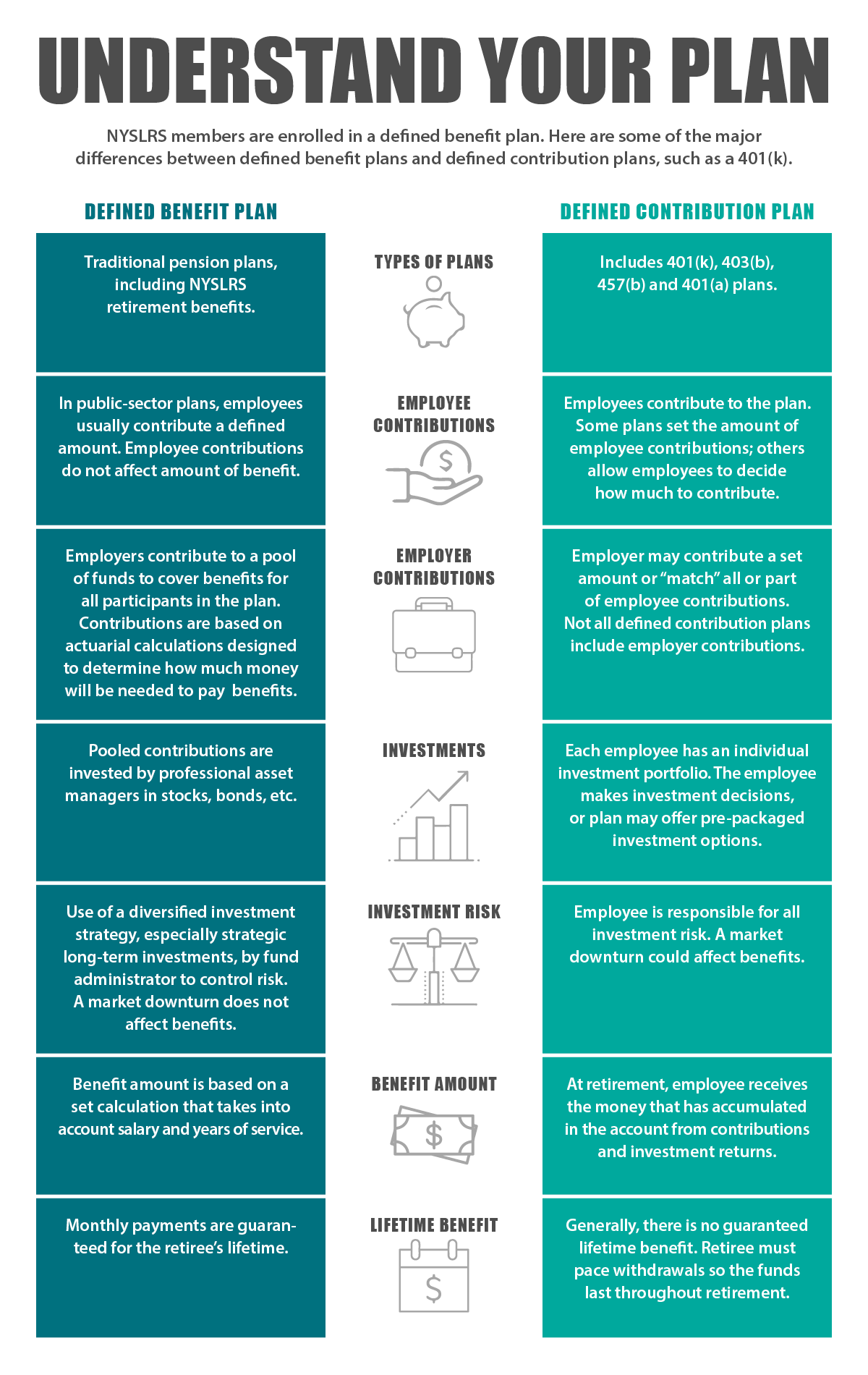

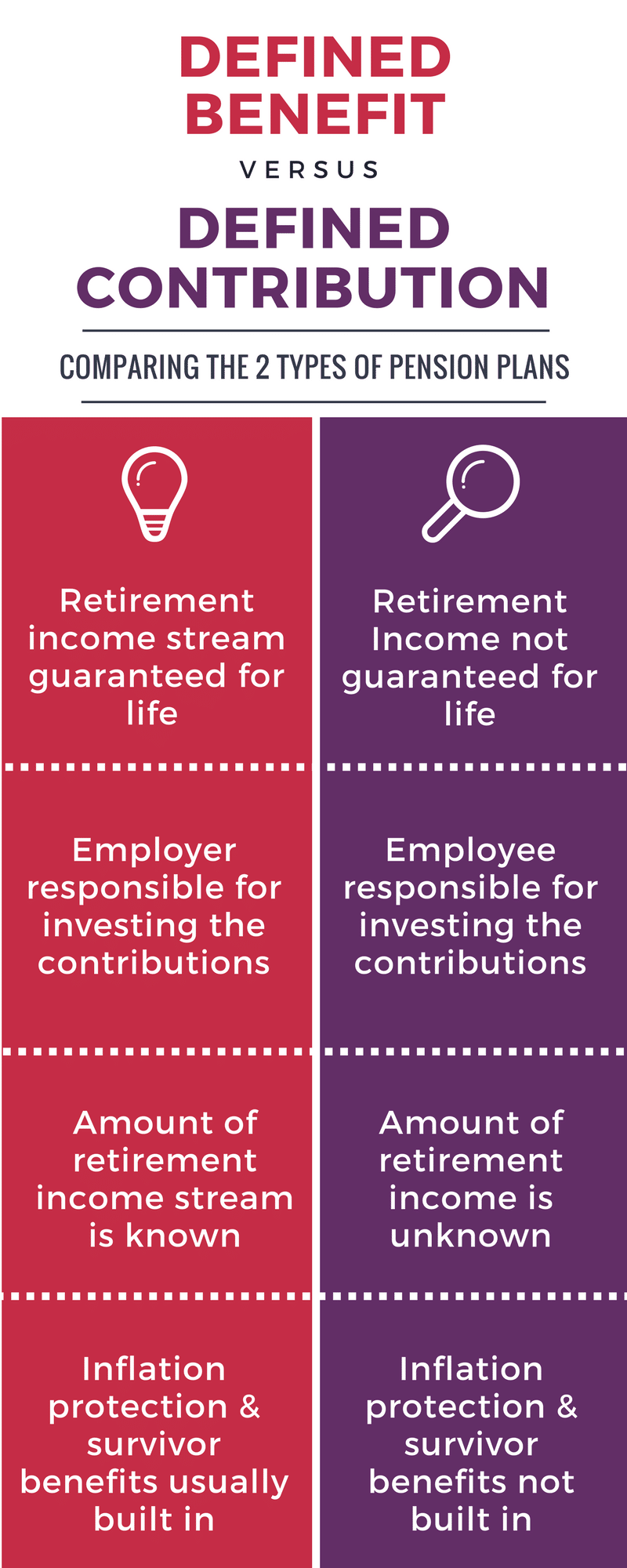

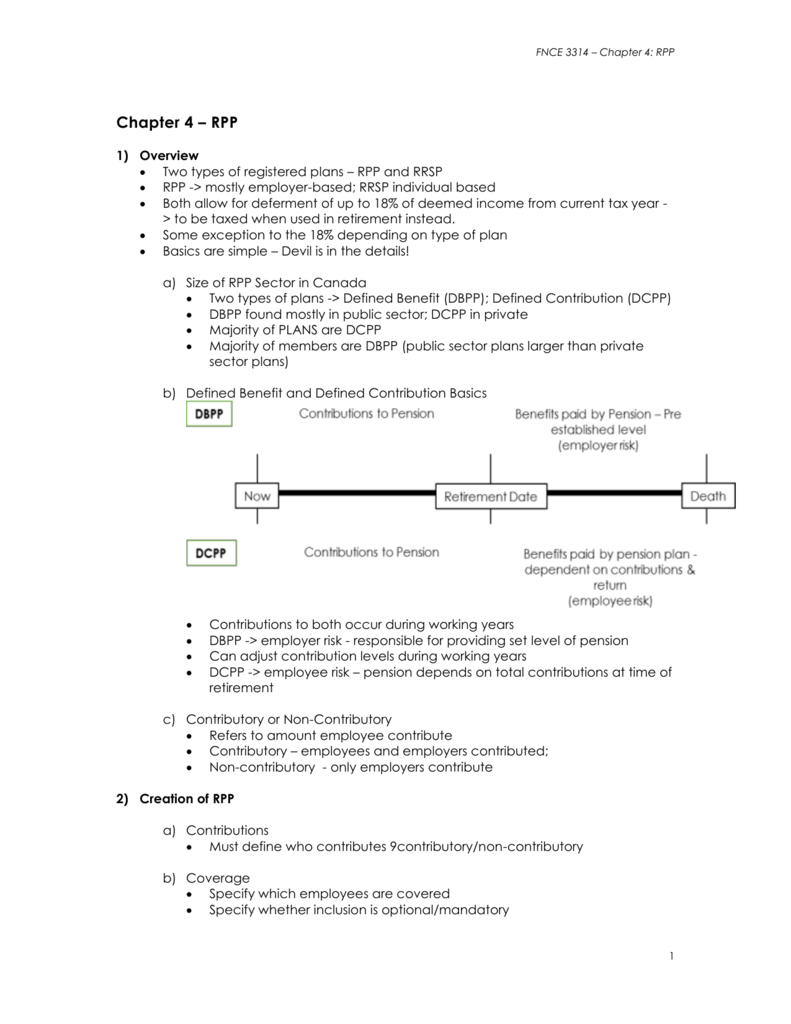

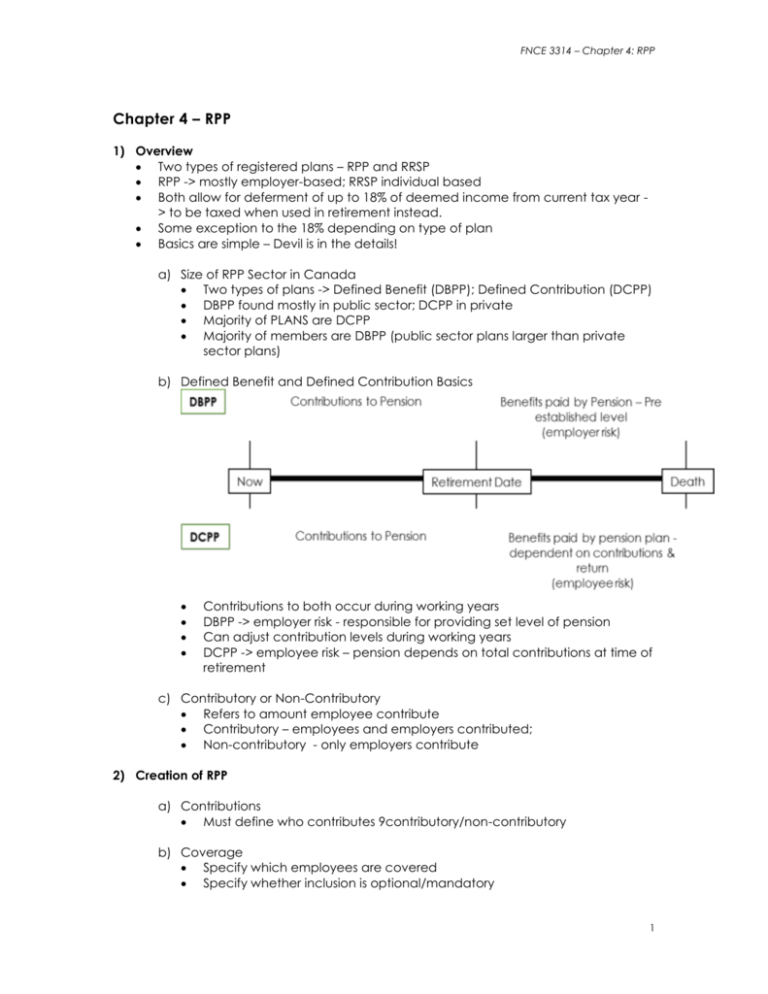

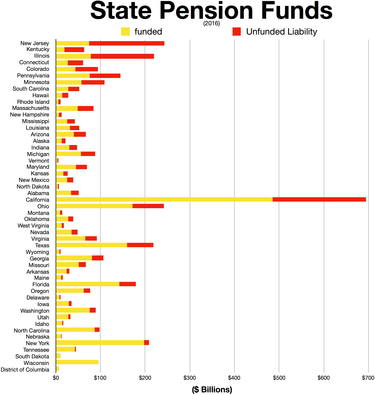

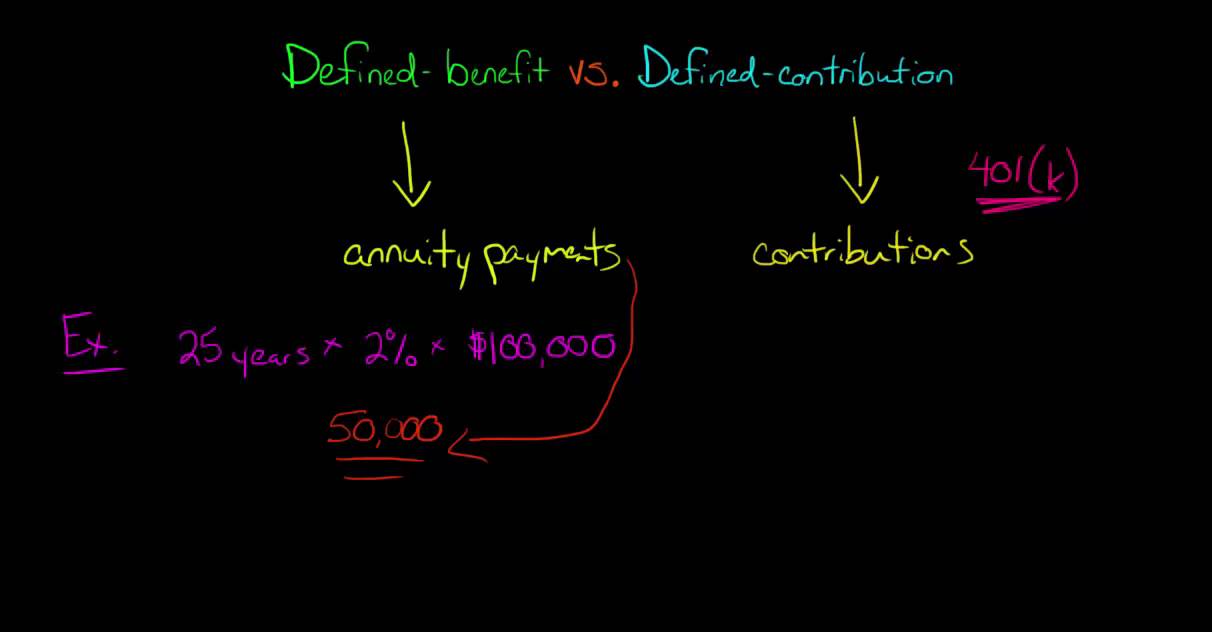

PDF Defined Benefit versus Defined Contribution Pension Plans ... 143 Defined Benefit versus Defined Contribution Pension Plans of $1,500 per year (1 percent x 10 years x $15,000) beginning at age 65. With a nominal interest rate of 10% per year, the present value (PV) of this deferred annuity at age 35 is $654.The increase in pension benefits as a result of working an additional year can be broken into Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... Defined-Contribution (DC) Pension Plans. This is the type of pension plan most commonly offered by employers. The benefits are based on contributions and investment returns. These pensions do not provide a guaranteed income in retirement, and they can be very risky depending on how well the plan investments perform. As the contributor, you are ... Defined contribution plans underfund workers' retirements ... Defined contribution plans underfund workers' retirements. Jan 17 2022, 3:57 PM. David Flemming's " Stopping the bleeding with pension reform" (VTDigger, Jan. 3) is an exercise in semantic ...

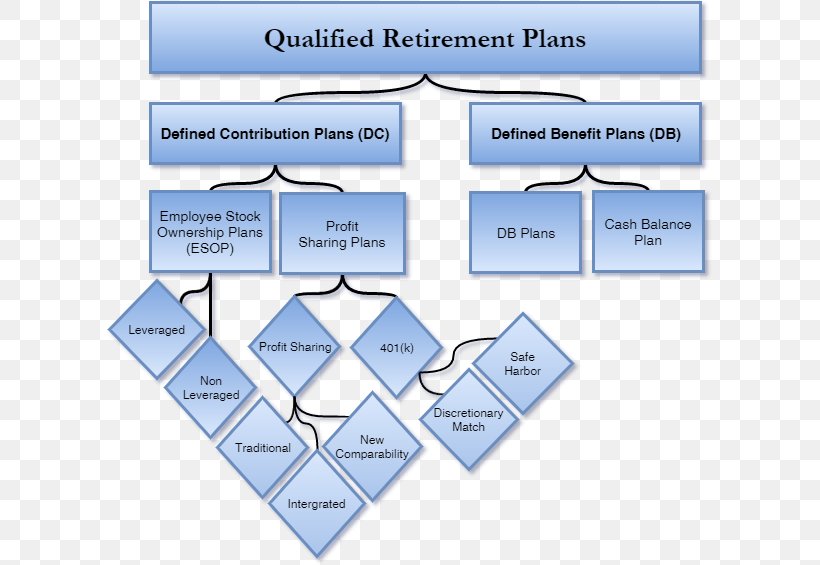

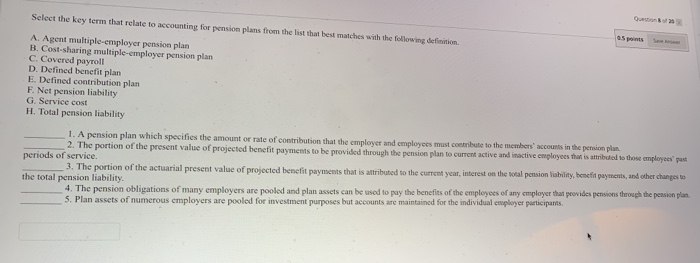

Defined contribution pension plan definition. Defined-Contribution Plan Definition A defined-contribution (DC) plan is a retirement plan that's typically tax-deferred, like a 401(k) or a 403(b), in which employees contribute a fixed amount or a percentage of their paychecks to ... Defined-Benefit vs. Defined-Contribution Plan Differences As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan —provides a specified payment amount in retirement. A defined-contribution plan allows employees ... Definitions | Internal Revenue Service Defined Contribution Plan is a retirement plan in which the employee and/or the employer contribute to the employee's individual account under the plan. The amount in the account at distribution includes the contributions and investment gains or losses, minus any investment and administrative fees. en.wikipedia.org › wiki › Personal_pension_schemePersonal pension scheme - Wikipedia A personal pension scheme (PPS), sometimes called a personal pension plan (PPP), is a UK tax-privileged individual investment vehicle, with the primary purpose of building a capital sum to provide retirement benefits, although it will usually also provide death benefits.

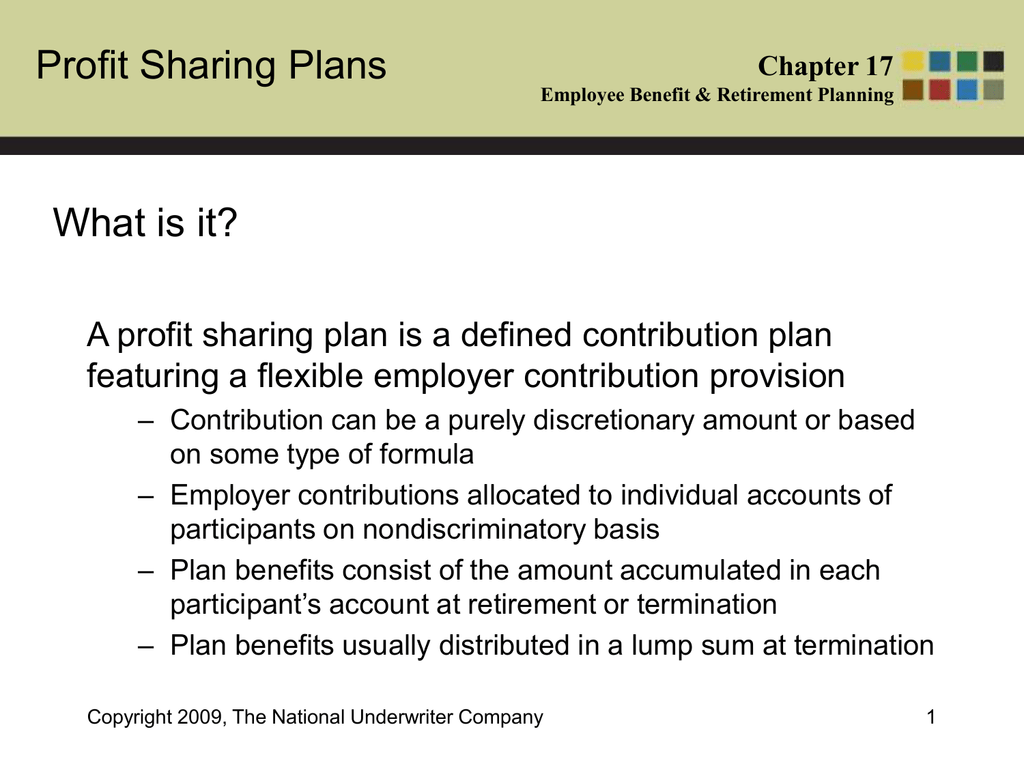

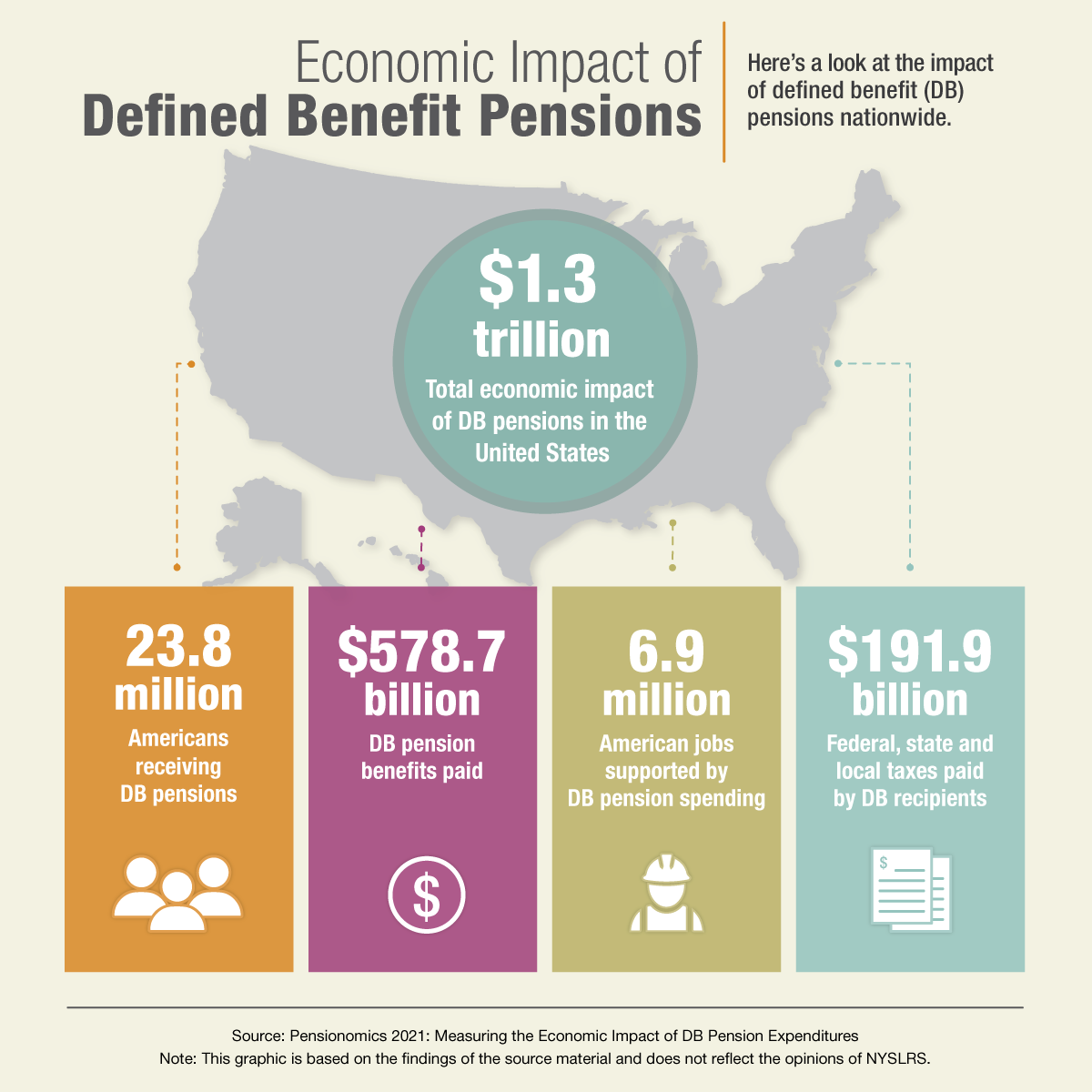

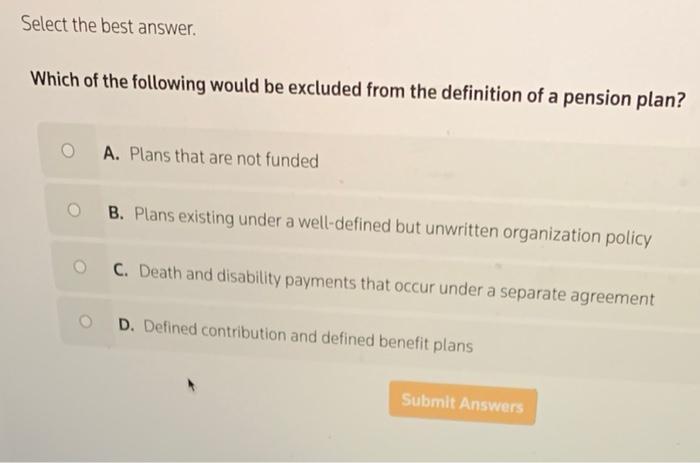

What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is a retirement plan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades.This decline is especially pronounced in the private sector, where more and more employers have shifted to defined contribution plans, like a 401(k). Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned.These contributions are often a fixed percentage of an employee's annual earnings and are deposited monthly in an ... Defined contribution plan definition and meaning | Collins ... A defined contribution plan is a tax-qualified retirement plan in which an employer's annual contributions are determined by a formula set for those in the plan. A defined contribution plan is a type of pension plan that specifies the annual contribution that the employer will pay on behalf of each plan participant. plan. What Are Defined Contribution Plans? Defined contribution plans are tax-deferred retirement plans managed by employers. The most common types are 401 (k) and 403 (b) plans. The employer often matches all or a portion of the amount the employee contributes. If your employer offers a defined contribution plan, it would be smart to take advantage of it.

Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ... What is a defined contribution plan? | BlackRock A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401 (k) and 403 (b) plans. Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the United States. Defined-contribution pension plan financial definition of ... A pension plan in which an employer's periodic payments into the plan, rather than eventual retirement benefits to employees, are specified. For example, a defined-contribution pension plan may require an employer to contribute 5% of its employees' gross pay into a fund with contributions earmarked for each employee upon retirement. What is a Defined Contribution Pension Plan? - Definition ... A defined contribution pension plan is a pension plan in which the employer makes a specific contribution per period of time, typically months or years. However, when the employee retires, the amount the employee can withdraw is not fixed. Instead, it depends on the success of the investments made. In the context of insurance, defined ...

Defined Contribution Pension Plan financial definition of ... A retirement plan in which the employee and/or employer contribute a set dollar amount each month. The benefits of a defined contribution plan are not set, and depend upon how well the contributions are invested before the pensioner starts to make withdrawals.The disadvantage of a defined contribution plan is the possibility that the investments will not perform as well as expected, giving the ...

Defined contribution plan - Wikipedia A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account.

Defined-Contribution Plan - Overview, Terms, Examples A defined-contribution plan (also known as a DC plan) is a type of pension fund payment plan to which an employee, and sometimes an employer, make regularly occurring contributions. Capital Gain A capital gain is an increase in the value of an asset or investment resulting from the price appreciation of the asset or investment.

PDF Defined Contribution Pensions: Plan Rules, Participant ... Over the last 20 years, defined-contribution pension plans have gradu-ally replaced defined benefit pension plans as the primary privately-sponsored vehicle to provide retirement income. At year-end 2000, employers sponsored over 325,000 401(k) plans with more than 42 mil-lion active participants and $1.8 trillion in assets.1

Types of private pensions - GOV.UK Types of private pensions. Private pension schemes are ways for you or your employer to save money for later in your life. There are 2 main types: defined contribution - a pension pot based on how ...

Defined Contribution Pension schemes Defined contribution pension schemes. With a defined contribution pension (sometimes called money purchase) you build up a pot of money that you can use to provide an income in retirement. Unlike defined benefit schemes, which promise a specific income, the income you might get from a defined contribution scheme depends on factors including the ...

Defined Contribution Plans: Final Project Paper - 2498 ... From: Date: September 23, 2013 RE: Pension Plans Defined Contribution Plan A defined contribution plan is a type of retirement plan where the employer contributes a certain amount each period to the plan but does not have any requirements as to the amount that will be paid out at retirement time.

Defined contribution schemes - The Pensions Authority Defined contribution schemes. Defined contribution (DC) schemes are occupational pension schemes where your own contributions and your employer's contributions are both invested and the proceeds used to buy a pension and/or other benefits at retirement. The value of the ultimate benefits payable from the DC scheme depends on the amount of ...

Defined Contribution Pension Plan in Canada: Complete Guide The defined contribution pension plan (DCPP) in Canada is a tricky topic for many people. It's the most common type of pension offered by employers today, so it's an important thing to understand. This article will go over all the ins-and-outs of a defined contribution pension plan in Canada

Defined Contribution Plan (Definition, Example) | How it ... Defined Contribution Pension Plan Definition. A defined-contribution pension plan is a form of retirement plan where the employee or the employer and in some cases both of them make significant amount of contributions and that too on frequent basis with a motive to enable employees to save a decent amount of money for his retirement period and allow him to leave with utmost level of dignity in ...

Defined contribution plan - definition of Defined ... Defined contribution plan synonyms, Defined contribution plan pronunciation, Defined contribution plan translation, English dictionary definition of Defined contribution plan. n. A sum of money paid regularly as a retirement benefit or by way of patronage. tr.v. pen·sioned , pen·sion·ing , pen·sions 1. To grant a pension to.

Defined contribution plan Definition & Meaning - Merriam ... Legal Definition of defined contribution plan. : a pension plan in which the amount of the contributions made by the employer is fixed in advance and earnings are distributed proportionately.

Defined contribution plans underfund workers' retirements ... Defined contribution plans underfund workers' retirements. Jan 17 2022, 3:57 PM. David Flemming's " Stopping the bleeding with pension reform" (VTDigger, Jan. 3) is an exercise in semantic ...

Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... Defined-Contribution (DC) Pension Plans. This is the type of pension plan most commonly offered by employers. The benefits are based on contributions and investment returns. These pensions do not provide a guaranteed income in retirement, and they can be very risky depending on how well the plan investments perform. As the contributor, you are ...

PDF Defined Benefit versus Defined Contribution Pension Plans ... 143 Defined Benefit versus Defined Contribution Pension Plans of $1,500 per year (1 percent x 10 years x $15,000) beginning at age 65. With a nominal interest rate of 10% per year, the present value (PV) of this deferred annuity at age 35 is $654.The increase in pension benefits as a result of working an additional year can be broken into

/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830-ed6f412b721d4dfc85f6cac9184c78ab.jpg)

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-45fb62eb90d14d7c834a05988c0b4945.jpg)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

/retirement-plan-and-pension---two-folders-on-wooden-office-desk-646371116-8c14e48c05494dc0b9b53a5c172ff8fb.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Senior_Raedle-56a9a64c3df78cf772a938a3.jpg)

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

0 Response to "41 defined contribution pension plan definition"

Post a Comment